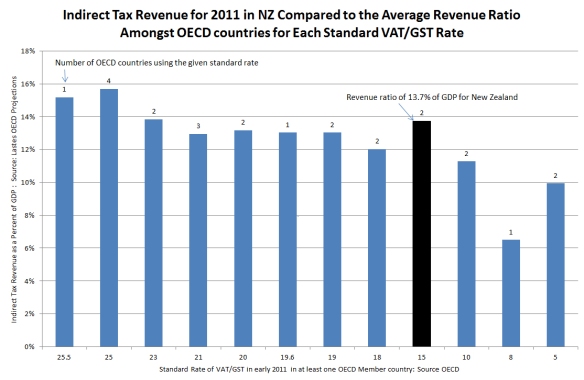

This week’s chart, prepared by Capital Economics Limited, suggests that New Zealand’s 15 percent broad-based GST could be giving it more revenue as a percentage of GDP than that typically being achieved by OECD member countries with standard rates for VAT/GST as high as 23 percent. (Many countries have non-standard rates or exemptions that reduce the revenue base.) The statistics are not conclusive as they are based on all indirect tax revenues, not just revenues from VAT or GST. The chart was motivated by this article in the OECD observer commending broad-based single-rate systems.

Roger Kerr, New Zealand Business Roundtable Executive Director

Kerr Comments