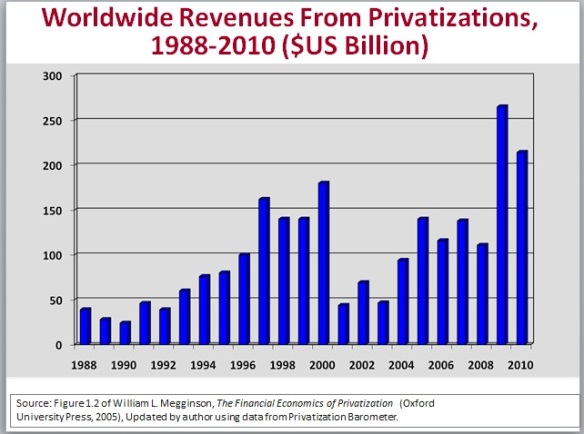

This chart comes from the presentations that Professor Bill Megginson of the University of Oklahoma gave in New Zealand this week. Megginson is arguably the leading academic expert in the field.

It shows that annual privatisation revenues have fluctuated but are currently at record levels.

The EU and US debt crises will no doubt give further impetus to privatisation. SOEs have been effectively eliminated in the United Kingdom.

Megginson lists the lessons of privatisation research as follows.

- Sales improve financial and operating performance

– impact on employment less clear-cut

– generally also yields fiscal bonus for government

- But, privatisation does not always ‘work’

– and governments often try to retain real control

- Investors have benefited from privatisation

– both short and long-term returns are positive

- Governments should sell assets as quickly as possible, for cash, to highest bidder

– favour SIPs (Share Issue Privatisations), allow foreign purchases when possible.

Visit www.nzbr.org.nz to view the presentation Professor Megginson gave at a New Zealand Business Roundtable CEO Forum.

Governments should sell assets as quickly as possible

Absolutely – the point is not to get some mythical “highest price” – the aim is to get rid of government ownership as fast as possible.

SOEs have been effectively eliminated in the United Kingdom.

Oh please. Last time I looked, something like 90% of schools and hospitals are still in public hands, along with the railways, roading network, BBC, radio, prisons…

But you’re right: the best thing the govt could do, in NZ or in the UK, is put the lot on ebay with a closing date of a couple of weeks.

Telecom was sold for about $4b. It had been transformed from the old Post Office days into a pretty tight ship. It even got a whole new fitout prior to the sale (the stuff that is now wearing out). For quite a few years the new owners got annual profits of about $800m out of it – by doing just the same things that Troughton and the SOE team had been doing.

Selling that was clever. Pricing it at a 20% ROI was a brilliant coup. And for long-term owners of the shares ….? The shares floated at $2.50 – went up to about $10 as the new US owners unloaded and has drifted back to about $2.50 on a good day. There’s a great investment.

If we assume all the sale funds went to repay debt (yeah right) then Douglas/Prebble sold something that was producing a 20% ROI to pay down some 6% debt. One has to wonder what they were smoking ……