A spate of Sovereign credit downgrades is occurring, with Italy featuring prominently this week following New Zealand’s downgrades the week before.

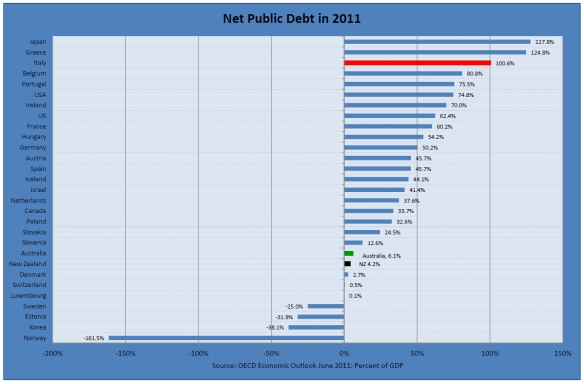

This week’s chart shows how fundamentally different the situation is in one vital respect between New Zealand and Italy.

In contrast to Italy, and the OECD as a whole, New Zealand does not have a public debt problem (yet, but watch this space given our underlying fiscal deficit).

Whereas 11 countries in the chart have net public debt at or above 50 percent of GDP, New Zealand’s ratio is only 4 percent of GDP according to OECD projections for 2011.

New Zealand has been downgraded for external debt reasons, but since the vast bulk of this debt is between private borrowers and lenders–who have every reason in 2011 to balance risk and return carefully and judiciously–this is a very different situation from that facing Italy and the ten other countries in the chart where government debt is clearly the problem.