Later this week the Labour Party is expected to unveil further policy, including a plan to introduce a capital gains tax.

I will not go into the general pros and cons of a CGT in this post. Many (myself included) think a CGT in some form has attractions in theory but that these are outweighed by thorny administrative considerations.

Rather, I focus here on the claim that a CGT on rental properties would dampen house price increases and make housing more affordable. According to Trans-Tasman, “Labour says New Zealand is one of the few nations which doesn’t have a CGT, and it will help prevent future speculative bubbles in the housing and rural property markets.”

First, what does theory tell us? Theory would suggest there is little relationship over time between house and other asset price increases and the presence or absence of a CGT. The introduction of a tax on investment properties could be expected to have largely a one-off effect (as with the introduction of GST): prices would fall to the point where previous after-tax returns were restored. But from that point on, normal supply and demand factors would largely determine the path of price changes.

Indeed the introduction of a CGT that is applied when capital gains are realised rather than progressively as they accrue could have the opposite effect to that assumed by Labour, at least for a time. Some owners of investment properties might keep them off the market longer to avoid paying the tax. Prices could go up rather than down.

As far as rents are concerned, there is no reason to expect a fall. To the extent that property investors succeeded in passing on some of the costs of a CGT, rents would be higher than otherwise.

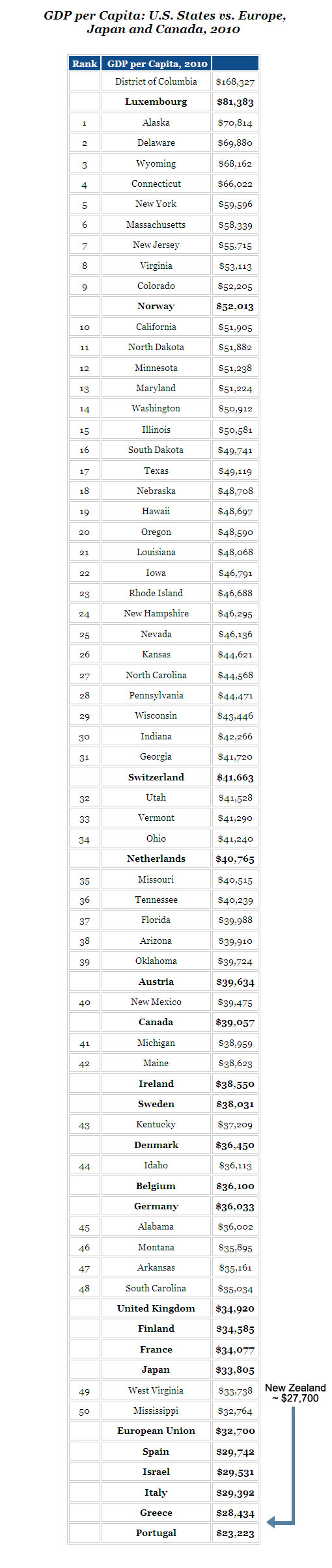

Does the empirical evidence support the theory? It appears so. New Zealand experienced a large increase in house prices in the last decade, but so did Australia which has a CGT. In its recent report on New Zealand, the OECD commented that “This surge in real house prices appears to have been triggered by the combination of a sharp inflow of migrants and easy credit conditions.” It added, “With similar developments occurring in Australia … a common Australia-wide macroeconomic trend appears to explain over 90% of movements in NZ house prices, giving rise to what amounts to a single housing market across both countries.” No mention of a CGT playing a role. Other countries with a CGT experienced similar house price increases. The OECD commented that “the introductions of capital gains taxes in Australia (1985) and in Canada (1972) did not have any noticeable immediate impact on aggregate house prices.”

On New Zealand, the OECD also noted that “Between 1990 and 2001, national average house prices had appreciated at an annual rate of only 2% in real terms, and even fell in a number of districts.” Clearly the absence of a CGT had no appreciable effect in that period.

For completeness, it should be noted that the OECD recommended a CGT or some other approach to reduce the tax bias in favour of housing (not to curb price increases). My preferred approach to this issue is to steadily reduce all high income tax rates (say to 20% or below). This would not eliminate the distortion but it would make it much smaller.

In line with the OECD’s findings, the New Zealand Productivity Commission noted in its recent Issues Paper on housing affordability that:

A combination of both supply and demand factors have been identified in explaining the surge in real house prices. These include a sharp inflow of migrants during the cycle, favourable credit conditions, a rise in average incomes, declining nominal interest rates, very low unemployment, strong gains in the terms of trade during the period (with dairy prices driving up rural land values), response lags of residential construction, increases in the costs of building homes and shortages in materials and skills. These factors likely inflated expectations of future house price increases, though it is difficult to determine whether a housing bubble had formed.

No mention of (the absence of) a CGT in the Productivity Commission’s analysis either.

A further point is that it’s hard to see how a tax that does not apply to owner-occupied houses, which account for the lion’s share of the housing stock, could be expected to have a material impact on house prices generally.

A final irony is that Labour is apparently proposing an increase in the top personal tax rate. A similar move by the last Labour government was regarded by many analysts as contributing to house price increases, whereas the present government’s moves to lower the top personal rate and the rate for most PIEs have reduced the relative attractiveness of housing investment.

It will be interesting to see whether journalists merely recycle claims that a CGT will “dampen house price increases” or seriously challenge them.