Labour MP Jacinda Ardern is arguing that the last Labour government’s abolition of the youth minimum wage (a project of former Green MP Sue Bradford) did not contribute to the current appallingly high rate of youth unemployment.

This is a bold assertion. Elementary economics suggests that, other things being equal, the higher the price for a good or service (such as labour), the less is demanded.

If all wage rates in the economy were doubled by legislative fiat tomorrow, there would be wholesale layoffs and unemployment would skyrocket.

The ceteris paribus condition is important. Legislated minimum wage rates may have little impact if they are below market rates – wage rates that employers would have paid anyway.

Similarly, increases in minimum wage rates may be consistent with increasing numbers employed at those rates if the labour market is buoyant (as it was in the first half of the last decade).

Jacinda Ardern quotes research by Hyslop and Stillman which found no consistent evidence of an adverse impact on teenage employment when youth wage rates were increased in this period.

But this Hyslop and Stillman study was published in 2007. It is not relevant to the effects of the Bradford legislation.

One way to get a feel for those effects is to compare the unemployment rates of 15-19 year olds and 20-24 year olds today with the comparable rates in the early 1990s when unemployment was also high.

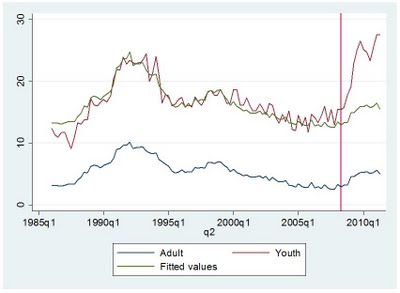

The following graph presents these unemployment rates for males.

Click to enlarge

The rate of 15-19 year old male unemployment in 2009 was comparable to the peak rate in 1991, which is not the case for the 20-24 rate.

The following chart plots the difference between these two series – and puts a 5-quarter moving average through the difference for greater clarity.

This chart clearly demonstrates that the 2009 recession has hit 15-19 year-olds harder relative to 20-24 year-olds than was the case in the 1988-91 recession.

If Jacinda Ardern thinks that the abolition of youth minimum wage is not responsible for this sharply different outcome, she needs to give another plausible explanation for it.

Eric Crampton of the University of Canterbury has estimated conservatively that the Bradford legislation has cost young people around 9000 jobs. He has also responded to Jacinda Ardern’s statement here.

Ms Ardern also needs to engage with the analysis of the 2025 Taskforce, which said in its last report:

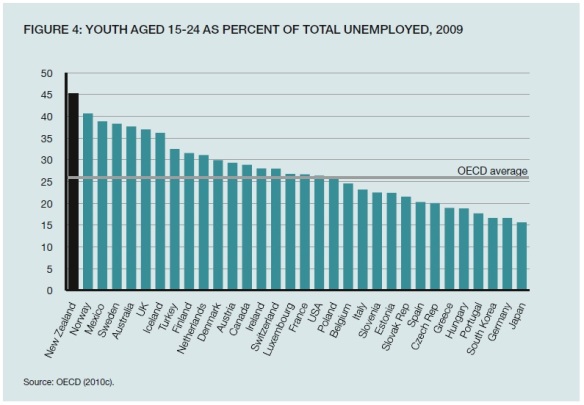

New Zealand has a relatively flexible labour market by the standards of some OECD countries, but this flexibility was reduced substantially over the period 2000 – 2009. International indicators of labour market rigidity in New Zealand tend to highlight our minimum wage,….

…..In the last decade, New Zealand has introduced substantial real increases in the minimum wage. The minimum wage was increased sharply during the boom years of labour shortages, and in 2008 the separate lower youth minimum wage was abolished (putting all young employees on the same minimum wage as adults). In 2008, New Zealand had the second highest minimum wage in the OECD relative to the median wage at 59 percent of the median wage, up from 51 percent of the median wage, in 2002. Only France, whose minimum wage at 64 percent, was more generous, and the OECD average is for the minimum wage to be at 46 percent of the median wage (OECD 2010a).

These changes have had a particularly serious impact on youth unemployment (Figure 12.2). Making sure that young people are easily able to get into the workforce is important for them and for the wider economy.

High minimum wages are also likely to seriously impede any determined efforts to reduce long-term welfare dependency. The case for any minimum wage at all is questionable, and we believe it should be reduced in value, but as a minimum we believe the Government should move to lower the real value of the minimum wage by holding it constant in nominal terms. Further, and as a matter of urgency, the youth minimum wage should be reinstated to assist in addressing the chronic youth unemployment problem currently facing New Zealand.